social security tax netherlands

If your business is based outside the Netherlands and you temporarily post employees to the Netherlands they can usually remain insured for social security purposes in their own country. The tax rates and tax credits pursuant to the proposals in the 2022 Tax Plan reveal the rate of the first bracket would be reduced by 003.

Income from substantial interest box 2.

. Contractors in the Netherlands classified as employees with flexible contracts are entitled to more benefits than those in other countries. However if the taxable amount is 395000 or higher companies are liable to pay a corporate tax rate of 258. As of 2020 for example you will pay less of an unemployment.

As this 30 is in simple terms considered as job related expenses. As a result workers exempted from Dutch social security coverage by the agreement pay no social. Is social security tax mandatory in netherlands.

Would you like more information about Dutch social security income tax. In principle every Dutch tax resident is liable to pay social security contributions on their earned income. Need more from the Netherlands Tax.

Tax credits reduce the taxable income in the order of the boxes. The Dutch tax system has divided taxable income into three categories. All Dutch residents must contribute to the countrys social security scheme.

Just a few simple steps to calculate your salary after tax in the Netherlands with detailed income tax calculations. 21 9 and 0. If their total value exceeds 15 the employer must pay 80 tax on the excess.

The rates of social security contributions in the Netherlands can slightly vary from year to year just like the personal income tax. Other payroll tax-related changes announced in the 2022 Tax Plan package concern. Social insurance when working temporarily in the Netherlands.

Please feel free to contact us through the contact form or call 085 003 0140 from within the Netherlands or. Dutch tax system. Each box has their own rate.

In 2022 if the taxable amount is less than 395000 a corporate tax rate of 15 applies. This page provides - Netherlands Social Security Rate - actual values historical data forecast chart statistics economic. The work-related costs scheme allows employers to provide some benefits tax free such as travel allowances study costs lunches and Christmas hampers.

The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for 2021. In addition to the Dutch social security taxes that cover old-age disability and survivors benefits the agreement also includes the Dutch taxes that cover health and sickness insurance benefits unemployment benefits and family allowances. As of 2019 the reduced rate for prime necessities is increased from 6.

Employers may provide such items tax free only if their total value is less than 15 of salary costs. As the employer the university also withholds pension premiums which are transferred to the pension fund. Generally if a taxpayer is sent to the Netherlands to work by a.

Netherlands 2022 Employer Social Security Rates and Thresholds Annual Insurance Resident Tax Rate Non-Resident Tax. A totalization agreement is in place between the Netherlands and the United States which gives some guidance about which country the social security taxes must be submitted to. Wage tax is a tax the employer deducts from the employees salary and transfers to the Dutch Tax Administration and Customs Belastingdienst hereafter Tax Office.

13 Investments and savings The sum of private assets and debt at the 1st of January is deemed to generate a yield of 2017 for amounts. Tax considerations for Dutch contractors. Any Dutch payroll tax already withheld on the income will reduce the amount of Dutch personal income tax payable.

179 old age social security 1 dependentspouse and 965 for long term care. The total state social security contributions are maintained at 2765 including general old-age social security AOW 1790 surviving dependent spouse social security ANW. Income from savings and investments box 3.

Review the 2022 Netherlands income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions pension contributions and other salary taxes in the Netherlands. Social security tax in the Netherlands. Changes to the work-related costs rules.

The contribution is 2815 percent of your salary but will never exceed about 9400 euros. Residency It is possible that an employees residency changes as a result of remote working as residency in the Netherlands is determined based on all the relevant facts and circumstances. There are three VAT rates.

In this article BDO addresses the impact remote working can have on expats from an income wage tax and social security perspective. Public and private companies in the Netherlands are subject to Dutch corporate tax on their profits. More information about social security or income tax in the Netherlands.

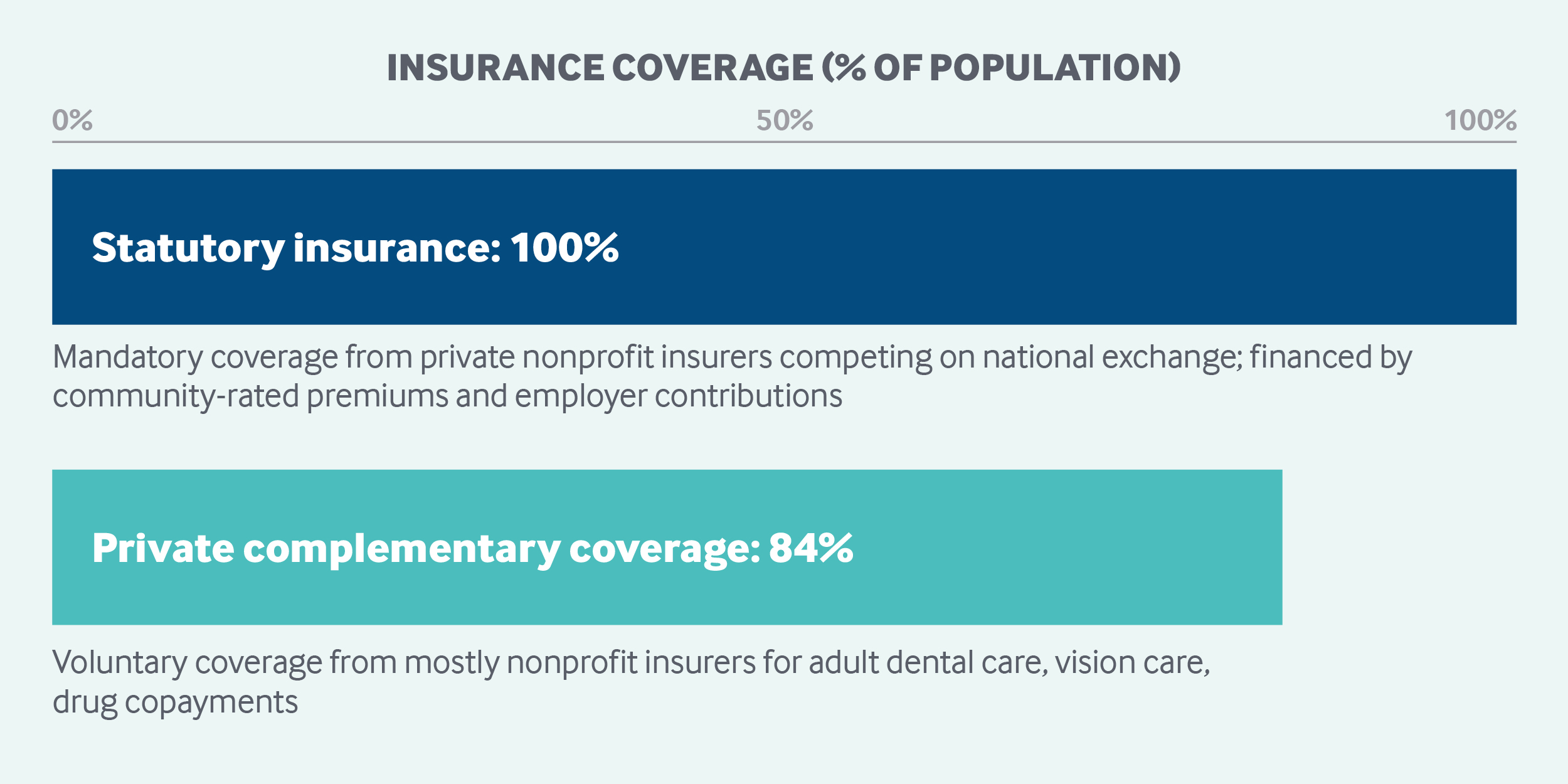

The Social Security Rate in Netherlands stands at 5124 percent. Employees are subject to social security contributions of 2765 of their gross salaries. The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for 2022.

Value-added tax VAT known in Dutch as Omzetbelasting or BTW is payable on sales of goods and on services rendered in the Netherlands as well as on the importation of goods and on the intra-European acquisition of goods. In the Netherlands payroll tax covers a broader set of withholding and contributions including income tax withholding and if you are new to employing in that EU-member country you will want to have a full understanding of the terminology and rates. Here are the main contributions to consider.

The income an individual receives is subject to Dutch personal income tax. The Dutch residency status is determined by facts and circumstances. The wage tax is levied at rates ranging from 9 to 51 depending on the salary.

The 30 rule means that 30 of your salary is considered as exempt from income tax and social security etc. Income tax includes wage tax and social premiums. Income from work and ones own home box 1.

The Dutch social security contribution is levied together with income tax. Social Security Rate in Netherlands averaged 4994 percent from 2000 until 2021 reaching an all time high of 5305 percent in 2005 and a record low of 4612 percent in 2017. The social insurance benefits in Dutch are set every six months.

The top rate of 4950 applying in 2021 would remain unchanged in 2022. The total state social security contributions are maintained at 2765 including general old-age social security AOW 1790 surviving dependent spouse social security ANW.

Us Expat Taxes For Americans Living In The Netherlands

Payroll Tax In The Netherlands A Guide For Global Employers

Payroll Tax Netherlands Safeguard Global

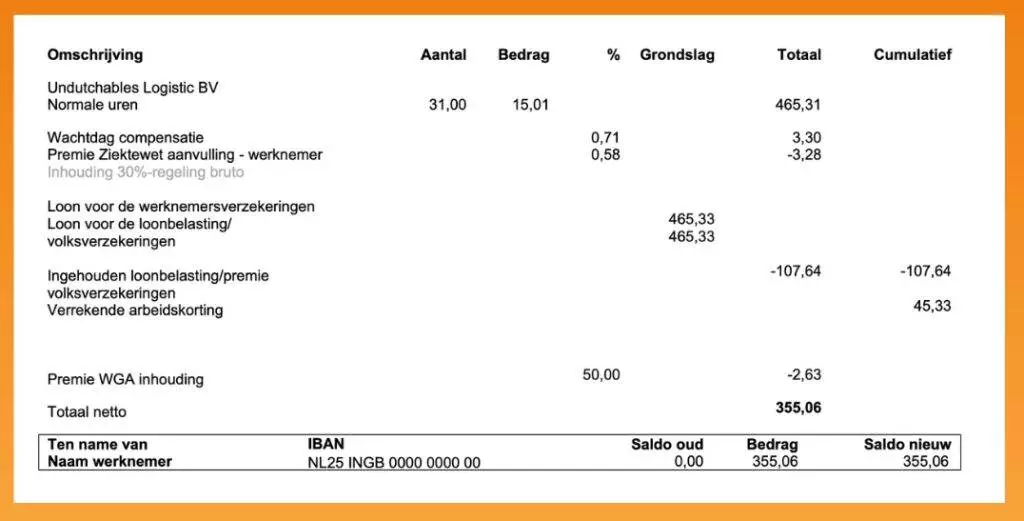

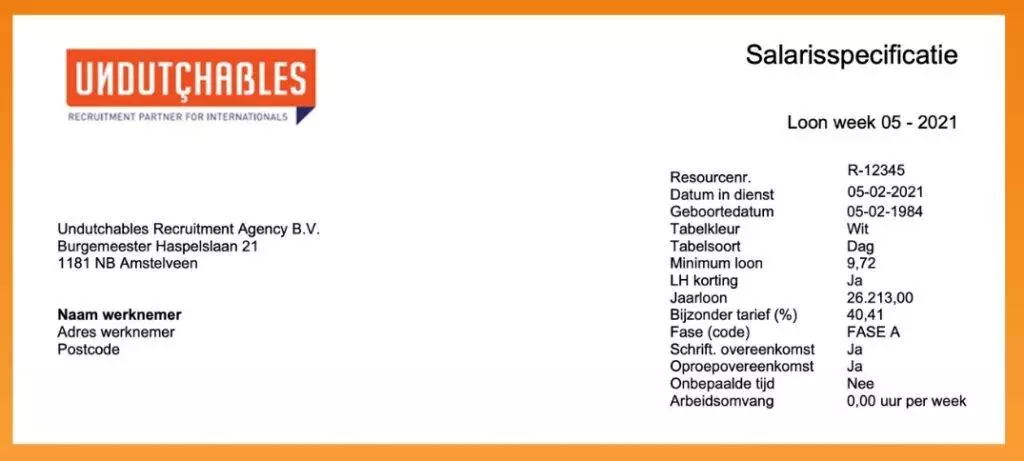

Payslip In The Netherlands How Does It Work Blog Parakar

Social Security Tax Netherlands Support For Employers Employees

Property Tax In The Netherlands

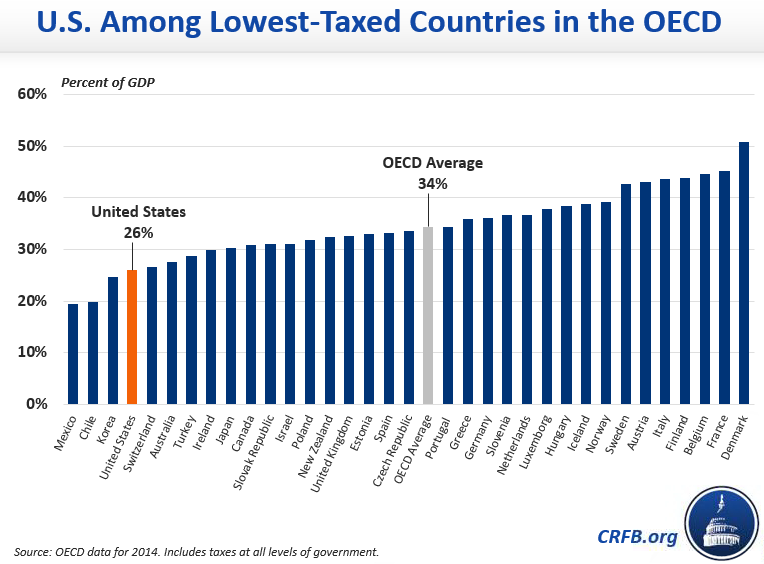

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Payslip In The Netherlands How Does It Work Blog Parakar

Payroll Tax Netherlands Safeguard Global

Australia Tax Income Taxes In Australia Tax Foundation

Us Expat Taxes For Americans Living In The Netherlands

How To Retire In The Netherlands As An American 2020 Aging Greatly

How To Read And Understand Your Dutch Payslip Dutchreview

Everything You Need To Know About Ssn Social Security Number

Payroll Tax Netherlands Safeguard Global

How To Read And Understand Your Dutch Payslip Dutchreview